All The Vital Information Needed For A Mortgage

You want to buy a house, in the worst way, but you are not sure if you will qualify for a mortgage.

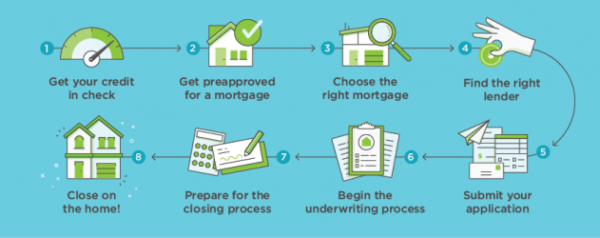

Here’s all the vital information you need to know to get started:

First, forget about everything everyone else told you and just pay attention to the facts. Much has changed in the mortgage world since the crash of 2008, but the basics have not. Mortgages are all about Income, Credit, and Assets. It is vital you’re “strong” on all three of those, and if you are, you will be fine. You’ll have busy work to do, but you will be fine.

A most common misconception is that if you are strong or exceptional on at least two of the three, that’s good enough. That was never really the case, exclusively, and it’s less the case today. I’ve seen borrowers with three or four times the value of the house in Liquid Assets get turned down due to low income or even sub-standard credit.

Second, up until 2007 or so, the industry was requiring less and less documentation every year. That’s flipped completely now. Lenders take nothing for granted, and you have to be prepared to provide extensive documentation and explanations about everything related to the three vital components.

Debt-to-Income (DTI) ratio is more important to lenders than ever before. Let’s talk income first- if you are self-employed, you have to use after-deduction earnings, but if you are a W-2 wage-earner, the gross income is basically used “as is” from pay stubs/w2’s and/or tax returns. If you have a W-2 position with even a month’s worth of job history, you should be able to qualify. Conversely, self-employed people must have two years of tax returns to somehow demonstrated to lenders that the income is likely to continue and can be used in a DTI calculation.

Debt information is primarily gathered directly from credit reports. For credit cards, a “minimum” monthly payment is used as a monthly debit entry (does not matter if you pay the balance in full or not). Car leases and other reported mortgages being carried, not including a mortgage on a property that will be sold prior to settlement, are all added into the monthly debt metric.

Add your monthly debt and divide by the monthly income and you need to have a ratio of close to 30 percent to have a debt/income that will be acceptable to just about any lender and any mortgage program. As the ratio climbs above 40 towards 50, you should not give up, but you will probably qualify for far fewer premium (“best rate”) mortgage programs if any at all.

Finally, the likelihood of approval will also be impacted by the ever-dreaded credit score. The higher the debt ratio, the better the score must be (700 plus). With a strong ratio, and a significant down payment (over 10 or 20 percent), it still may be possible to get by with a score in the 600-650 range. Another misconception as it relates to Credit is that “score” is the be all and end all measurement. It’s not. If your score is over 700 but you have been late recently on a single mortgage payment, you could be denied.

On home purchases, it is true that the more someone puts down, the better the chances to qualify. However, anything over 25% down is probably not going to improve rate or qualifications – aside from the fact that the more down results in a lower monthly payment. You can get a mortgage with as little as 3% down. However, you could be subject to mortgage insurance and won’t qualify for the best programs if you put down less than 20 percent.

In closing, don’t fight the Big Banks and Government Regulations. It does not matter how ridiculous some of the requirements may seem. The most likely applicants to qualify are strong-balanced Income, Credit, Asset profiles combined with a highly responsive, dutiful positive energy put forth until the process comes to a long-awaited close.

Remember, as frustrating as it can be at times, it is “their money” you are asking for, and you have to play by the Lender’s rules and the Government’s oversight.

Story by Michael Lubell